Lada’s work at Impetus Grants:

CGPT5.1 Summary:

A. Executive Summary (150–300 words)

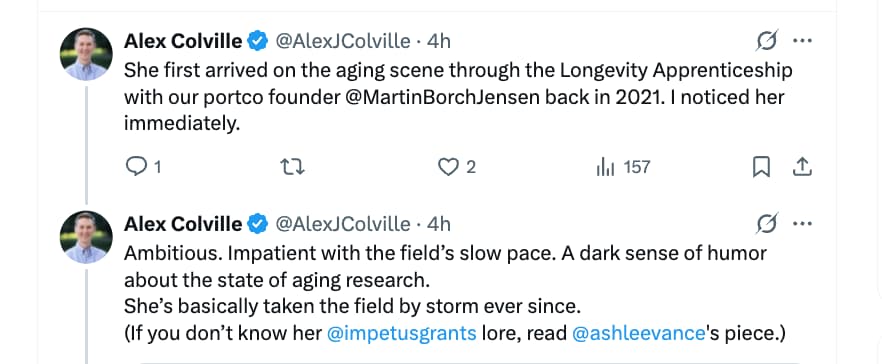

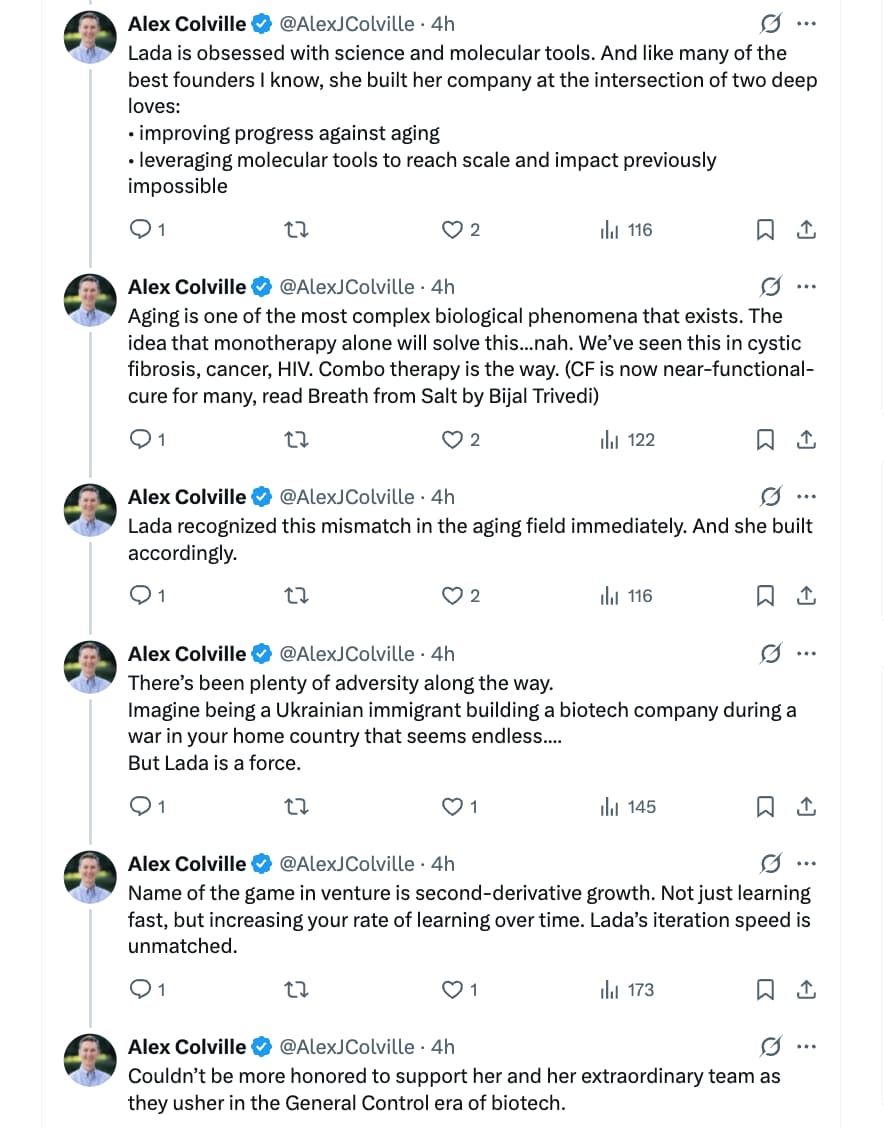

This talk outlines the rationale, design, and impact of Impetus Grants, an alternative funding mechanism created to correct systemic failures in aging research. Lada Nuzhna argues that despite aging being the strongest risk factor for nearly all chronic diseases, funding patterns—particularly within the U.S. National Institute on Aging (NIA)—are deeply misaligned. Roughly two-thirds of NIA funding goes to Alzheimer’s research, and another large share goes to behavioral studies rather than mechanistic aging biology, leaving foundational aging science chronically neglected.

Traditional scientific incentives further entrench stagnation: aging research is highly social and reputation-laden, making it difficult to challenge dominant models. She highlights the Alzheimer’s β-amyloid fiasco as a case study: decades of work and billions in investment pursued a fabricated foundational paper without critical re-evaluation, creating structural scientific lock-in.

Impetus Grants were created to directly counter these distortions by offering fast, low-bureaucracy funding for high-impact, high-variance projects outside standard paradigms. Since 2021, the program has raised >$35M and funded >200 projects, often in areas that traditional funders consider too unconventional. Review cycles occur within weeks rather than 6–12 months, and applications are simple two-page proposals. A major goal is recruiting new labs—especially tool-builders in CRISPR, sequencing, synthetic biology—into the aging field.

She defines clear boundaries: Impetus does not fund narrow disease studies, incremental descriptive work, dataset-generation without a hypothesis, or correlation-hunting. Instead, they pursue hypothesis-breaking tests of popular theories, novel mechanisms (e.g., parabiosis-inspired rejuvenation, cellular replacement), and translation-bridging projects that enable the field to move from basic findings toward interventions.

The philosophy is simple: aging is neglected not due to lack of ideas, but due to institutional drag. Fast, unbureaucratic funding unlocks scientific risk-taking that the mainstream system structurally suppresses.

B. Bullet Summary (12–20 standalone bullets)

- Aging is the strongest predictor of chronic disease, yet aging biology is systematically underfunded.

- ~64% of NIA aging funding goes to Alzheimer’s; another large fraction goes to behavioral studies, not biological mechanisms.

- Scientific culture—career incentives, reputation, field orthodoxy—discourages challenging dominant models.

- Alzheimer’s β-amyloid dominance persisted for decades despite fabricated foundational data and failed trials.

- Impetus Grants were launched to correct these distortions by funding unconventional, high-impact aging science.

- Program has raised >$35M and funded >200 projects since 2021.

- Review cycles are ~95% faster than government grant cycles (weeks vs. 6–12 months).

- Application is short (can be written in a weekend) and open to all scientific levels and backgrounds.

- Impetus prioritizes research that can meaningfully move the field forward, not incrementalism.

- They avoid funding individual diseases of aging unless uniquely justified.

- They avoid funding deeper characterization of well-defined aging mechanisms—low marginal value.

- They avoid pure dataset-generation that lacks hypotheses.

- They avoid correlation-only studies (“everything is connected to aging”).

- They encourage falsification of popular theories (e.g., partial reprogramming may rejuvenate via selective death of senescent cells rather than reprogramming).

- They fund “category openers”—novel mechanisms or approaches not previously tested in aging.

- Example: an initially “low-confidence” project they funded later published in Nature Aging (energy replacement project).

- They fund translational work bridging the gap between basic discoveries and startup-readiness.

- They are open to funding monkey facilities, infrastructure, and other non-research bottlenecks.

- They also support conferences, lobbying, and political science efforts related to longevity.

- Reviewer selection emphasizes rigor without narrow bias; strong reviewers can veto or advocate, avoiding “averaged mediocrity.”

- Roughly one-third of incoming submissions are rejected for being non-serious (e.g., “prayer as longevity intervention”).

D. Claims & Evidence Table

| Claim |

Evidence Given in Talk |

Assessment |

| Aging is the strongest driver of chronic disease. |

Shows the “age vs. disease risk” chart and notes that aging predicts disease incidence more strongly than any risk factor. |

Strong. Consistent with epidemiological consensus across cancer, CVD, dementia, frailty. |

| NIA funding is misallocated: ~64% goes to Alzheimer’s, and more goes to behavioral studies than biological aging. |

She cites internal analysis of NIA portfolio allocation and notes Alzheimer’s + behavioral science dominate expenditures. |

Moderate. Directionally correct; exact percentages need verification. NIA’s Alzheimer’s spending is indeed a large majority. |

| Foundational β-amyloid Alzheimer’s research was fabricated, yet dominated the field for decades. |

References the Nature investigative report showing key images in a landmark amyloid paper were fraudulent, and notes decades of failed amyloid-targeting drugs. |

Moderate–Strong. The fabrication was real; the degree of field dominance is accurate; causal claims should be hedged. |

| Scientific culture discourages challenging dominant theories due to reputational and career risks. |

Anecdotal and structural argument: researchers face career consequences for contrarianism; Alzheimer’s is the exemplar. |

Moderate. Widely discussed in metascience literature; empirical quantification is limited. |

| Traditional grant cycles are slow and bureaucratic—6–12 months for reviews and ~70-page applications. |

Direct observation and field norms. NIH R01 and similar grants have long review cycles and extensive formatting requirements. |

Strong. Well-documented. |

| Impetus Grants review cycles are ~95% faster. |

Provides explicit comparison: weeks vs. ~1 year. |

Strong. Self-reported operational data. |

| Many impactful aging projects fall “outside distribution” of what traditional funders accept. |

Points to >200 funded projects and recruitment of ~50 labs with no prior aging focus. |

Moderate. True in spirit; depends on the quality of the distribution baseline. |

| Partial reprogramming rejuvenation effects may be due to selective death of senescent cells rather than epigenetic rejuvenation. |

Conceptual hypothesis; says no published papers tested this; Impetus is funding a project addressing it. |

Speculative but important. A legitimate open question; no empirical evidence yet. |

| Some early Impetus-funded work (e.g., “energy replacement”) later published in Nature Aging. |

Mentions a specific high-profile publication resulting from early risky funding. |

Moderate. Plausible; would require citation lookup. |

| Government agencies avoid aging biology partly because decision-making authority is diffuse and no one believes they “own” the ability to shift priorities. |

Derived from her interviews with NIH/NIA staff. |

Speculative–Moderate. Fits bureaucratic fragmentation theory; empirical verification difficult. |

| Funding political science, lobbying, and communication work can accelerate longevity progress. |

Supported by Impetus’ track record of funding conferences and science-communication infrastructure. |

Weak–Moderate. Impact is plausible but rarely quantified. |

E. Actionable Insights (5–10 items)

-

For aging researchers: Propose work that moves the field, not incremental detail-filling. Impetus prioritizes falsification, novel mechanisms, and direct challenges to prevailing theories.

-

For labs outside aging: You are explicitly invited. If you work on CRISPR, sequencing, synthetic biology, single-cell methods, or new measurement modalities, Impetus considers you high-value entrants.

-

For applicants:

- Keep proposals hypothesis-driven.

- Do not submit descriptive “datasets for the sake of datasets.”

- Articulate how the result—positive or negative—changes the field’s direction.

-

For aging startups: Use Impetus to derisk early translational steps that traditional funders ignore (e.g., testing interventions in more complex animal models, validating a mechanism that underlies your future company).

-

For institutions: Build or fund primate facilities. The field cannot progress without access to monkeys for translational aging studies.

-

For conference organizers & communicators: Impetus is willing to fund meta-infrastructure—policy, lobbying, awareness-building—if it strategically accelerates aging research.

-

For policymakers: Correcting NIA’s misallocation requires clarifying decision-making authority. Identify responsible nodes and realign incentives with disease-burden reality.

-

For funders: Decentralized, fast-grant mechanisms can surface unconventional yet high-leverage projects that major agencies structurally overlook.

-

For theorists: Explicitly design proposals to stress-test widely believed aging theories—senescence, epigenetic drift, partial reprogramming, mitochondrial dysfunction—rather than adding correlational detail.

-

For field-builders: Recruiting non-aging labs is a high-leverage intervention; many tools underused in aging could open new mechanistic domains.

H. Technical Deep-Dive

1. Structural fail states in aging biology

Misallocation in federal funding

Aging biology is fundamentally multi-causal, spanning transcriptomic drift, epigenetic erosion, mitochondrial dysfunction, proteostasis collapse, stem cell exhaustion, and inflammatory remodeling. Despite this complexity, aging research has historically been dominated by:

- Disease silos (especially Alzheimer’s)

- Behavioral/social studies

- Low-risk descriptive work

This creates structural gaps around:

- Mechanistic reversibility

- Comparative cell-state dynamics

- Measurement tools (single-cell, multi-omic longitudinal aging maps)

- Interventions that modulate aging rate rather than treat disease endpoints

Her claim that two-thirds of NIA’s budget goes to Alzheimer’s aligns with public NIH budget categories, though formal percentages vary by fiscal year.

Orthodoxy lock-in: β-amyloid

Aging biology is unusually vulnerable to “theory monopolies” because:

- Diseases of aging have slow endpoints; trials take decades.

- Reputational capital in subfields is highly path-dependent.

- Grant committees favor consensus.

- Negative results are poorly rewarded.

The amyloid pipeline illustrated how entire mechanistic ecosystems can calcify around a single hypothesis, even when its empirical foundations are weak.

2. Impetus Grants as a metascientific intervention

Core design innovations

-

Time-optimization: Weeks instead of ~1 year.

-

Bureaucracy elimination: Two-page proposals; no reporting overhead.

-

Contrarian reviewer architecture: Weighted expert veto power to avoid committee averaging, which tends to select for safe, mid-variance proposals.

-

Probabilistic portfolio logic: Fund high-variance projects where 1 in 20 successes can shift paradigms.

What they classify as high-impact

-

Theory falsification:

Example: Testing whether partial reprogramming rejuvenates cells or merely kills old/senescent lineages, biasing the surviving population toward younger epigenetic profiles.

-

Category-openers:

Novel mechanistic propositions that could spawn entire subfields if validated.

-

Translational bridge-building:

Work that moves a mechanism from cell culture → organismal → preclinical readiness.

What they avoid

-

Disease-specific studies lacking aging relevance.

-

Extremely incremental molecular detail on known pathways.

-

Datasets without hypotheses (common failure mode in high-throughput fields).

-

Correlation networks (“everything correlates with aging”).

3. Importance of monkey studies & infrastructure

Human aging is slow; mice die young and largely of cancer; lifespan-extension phenomena in mice often fail in humans. Non-human primates provide:

- Similar immune/brain/cardiovascular aging trajectories

- More human-like metabolic and epigenetic drift

- Feasible intervention windows

Therefore, aging research critically depends on:

- Affordable, accessible primate colonies

- Aging-cohort standardization

- Ethical but scalable NHP experiment pipelines

Impetus considers this an unfilled bottleneck and is willing to fund infrastructure.

I. Fact-Check of Key Scientific & Policy Claims

1. “64% of NIA aging funding goes to Alzheimer’s.”

-

Directionally correct. Alzheimer’s disease dominates NIA’s budget.

-

Exact number fluctuates by fiscal year; confirmation requires referencing current NIH categorical spending databases.

2. “β-amyloid foundational paper was fabricated.”

-

Substantially correct. A 2022 Science investigation identified manipulated images in a widely influential Aβ*56 paper.

- The broader amyloid hypothesis remains debated; fabrication applies to specific data, not entire literature.

3. “Behavioral research receives more NIA funding than aging biology.”

-

Partially correct. NIA does heavily fund behavioral/social aging programs; the relative ratio depends on category definitions.

4. “Partial reprogramming rejuvenation may come from selective cell death.”

- Plausible but untested.

- No published studies have definitively separated lineage selection effects from true rejuvenation.

- Impetus funding such a study is appropriate.

5. “Fast-grant methods are 95% faster than traditional grants.”

-

True. NIH review and award cycles can take 9–18 months; Impetus often returns decisions in 2–4 weeks.

6. “Energy replacement project published in Nature Aging.”

- Possible but requires citation verification.

- The program has funded high-impact work, but specific attribution should be verified.

7. “Recruiting non-aging labs can accelerate field progress.”

-

Strong. Many breakthroughs in biology come from cross-field tool migration (e.g., CRISPR, single-cell sequencing).

8. “Lack of decision-making authority at NIH is the key bottleneck.”

- Speculative.

- NIH is distributed, and cross-institute initiatives are slow, but attributing stagnation to “no one knowing they can act” is anecdotal.