This is good news. Laura and Alex continue to identify and fund promising new startups in the longevity field, and while the $35 Million is pocket change in the biotech investment business, this help will drive the early-stage, longevity startup ecosystem.

Dr Alex Colville joins forces with Laura Deming to advance The Longevity Fund’s mission and lead investments in longevity science moonshots.

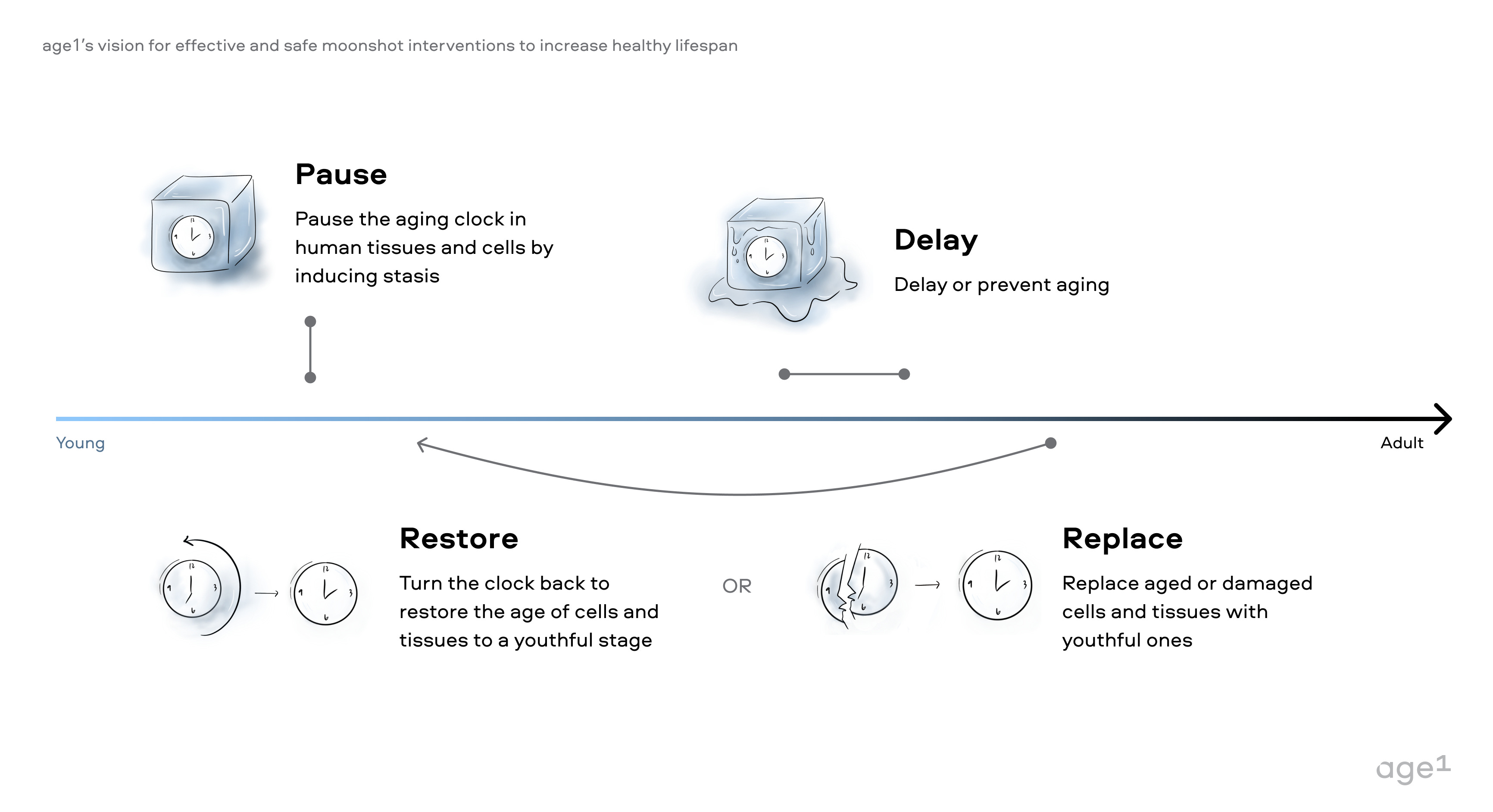

San Francisco-based age1, a venture capital firm catalyzing the next generation of founder-led longevity biotech companies, launched today to build a community of visionaries advancing new therapeutics, tools, and technologies targeting aging and age related disease.

Related:

Laura Deming has written a post on her Longevity.VC website about her take on the industry and where its giong:

The longevity field will play out in 3 stages:

Pioneers (2013 - 2023): companies started in this decade show you can make financial returns building a longevity company, and get reasonable drug candidates to patients for specific age-related diseases.

Dominant players (2023 - 2050): I think we’ll see a wave of the best founders the field has ever seen. They’ll be prepared with the right resources to build the companies that 1) will go on to get the first approved longevity drugs (for age-related diseases, with ongoing plausibly successful trials for lifespan by the end of the decade) and 2) enter major biotech leagues ($10B+ valuations, enduring pharma co), and 3) scale to change how 50+ year olds plan their time and energy.

Generic players (2050+): developing drugs for longevity will feel as obvious and mainstream as developing drugs for cancer. The field will receive substantially more public and private funding. Large pharma companies will have teams working solely on longevity. A few of the largest companies, with drugs on the market, will be companies dedicated to increasing human longevity and biotech funds will regularly diligence and invest in longevity companies.

Read More:

And more information on Age1’s Substack: