If you want to help move the longevity industry forward faster, become an investor! Some details from a Venture Capitalist viewpoint:

And, if you’re an interested potential investor, a good point to start is the website of ex-Googler, and very active angel investor in this space; Karl Pfleger: Aging Biotech Info

In rapidly emerging sectors, such as longevity, being open about your investment thesis is vital as it demystifies new technologies, lowers the barrier of understanding, and reduces the entrance anxiety of emerging fund managers and LPs.

In our work at LongeVC, being public about our investment logic has proven to be an asset for our investors and portfolio companies. In this piece, I’ll share more about how we map the longevity investment landscape and what this means for our work and the sector as a whole.

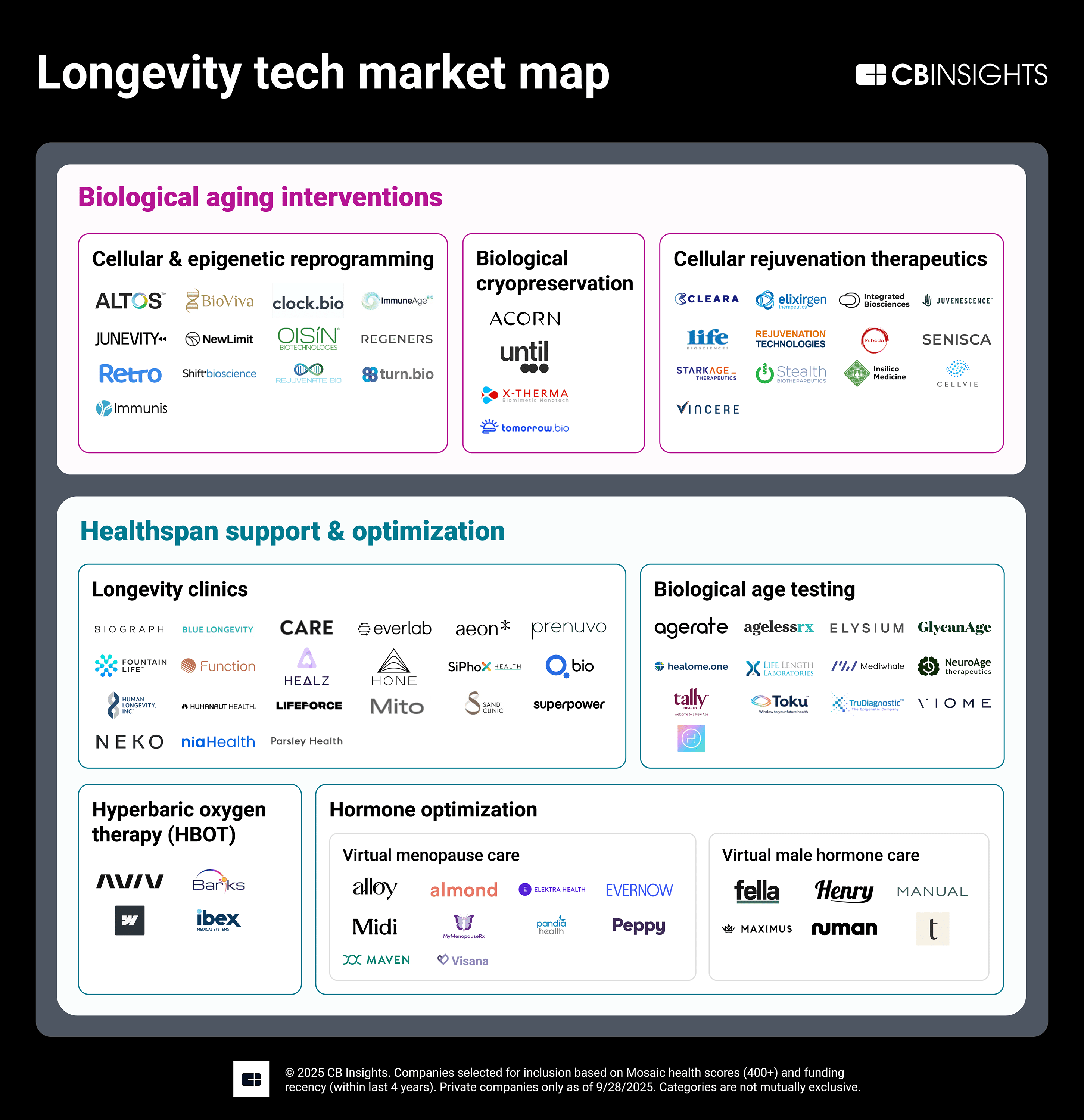

Exploring the longevity map

The first step in breaking down investment logic is establishing segmentation between the nature of companies and their products. As of today, LongeVC uses the following categories to classify our work:

Therapeutics targeting age-related diseases

Personalization and diagnostics (these can be called non-therapeutics for simplicity, although the term is fairly unprecise)

Longevity infrastructure builders

As you may have noticed, these breakdowns are still quite broad. Within each category, there are several different business models and exit scenarios–I’ll go into more detail on these below.