A prompt I’ve just done with CGPT5:

what would be the best profit maximizing strategy for a new longevity drug that could be used by anyone over 50 years of age in the USA. What would be the best price for the drug, assuming that for the first 4 years you would be someone volume limited (only able to sell to a few million customers due to manufacturing constraints that are typical with any new product), assuming the current income distribution in the USA.

Response:

Here’s a tight, profit-first launch plan under a capacity cap of only “a few million” US patients 50+ over the first 4 years.

1) Positioning & channel

-

Cash-pay first, payer later. With scarce supply, sell directly (DTC + concierge/clinics). Defer broad payer rebates until Year 3–4 when capacity rises; early payer access should be narrow/outcomes-based.

-

Outcomes + biomarker bundle. Sell the program, not just pills: baseline panel → quarterly tracking → telemed check-ins. That increases willingness-to-pay (WTP), reduces churn, and justifies premium tiers.

-

Founders/concierge cohorts. Invite only, limited slots, white-glove onboarding. Scarcity supports price skimming.

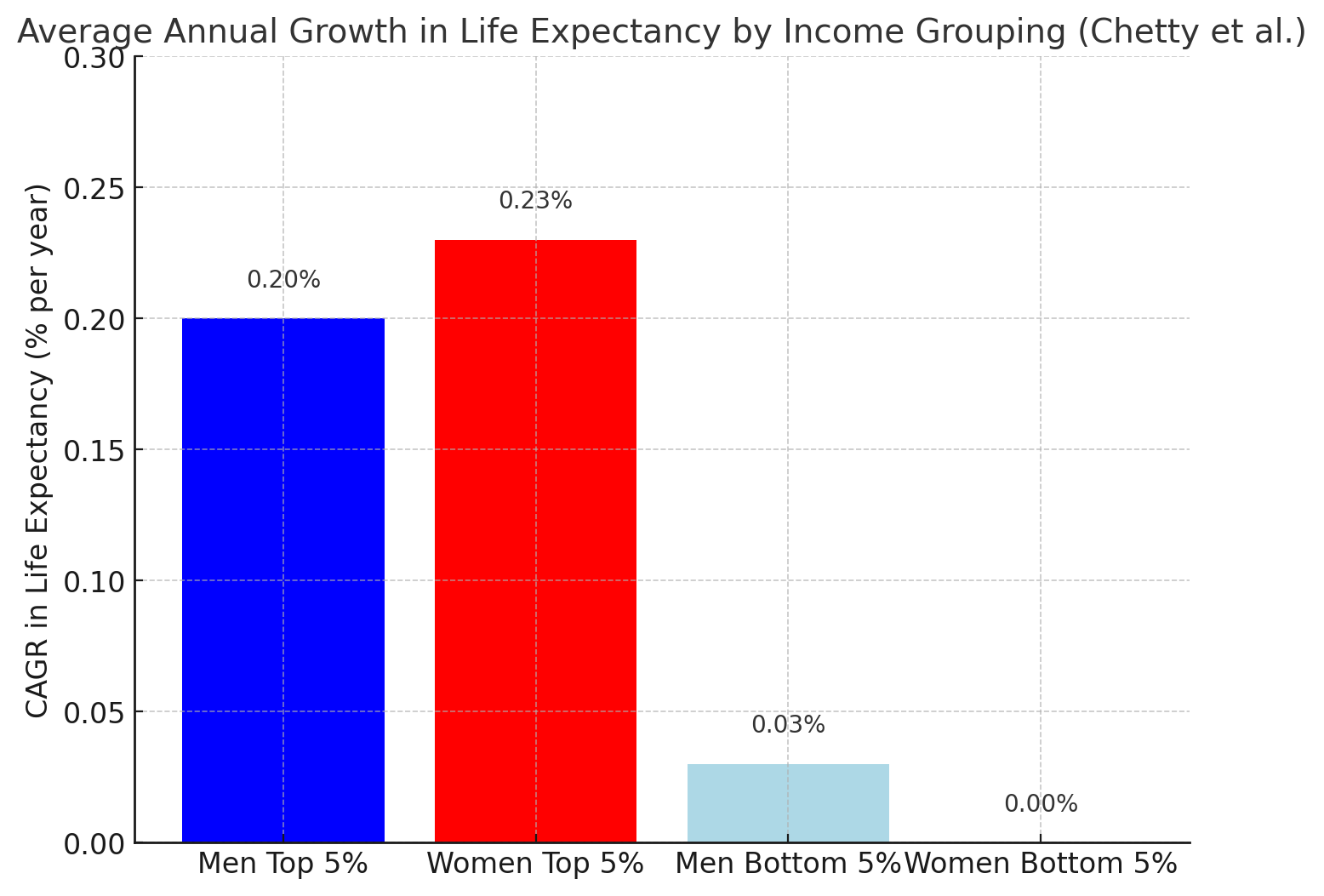

Why this works now: there are ~123–124M Americans age 50+ (2024–2025), far more than you can serve; median household income is ~$83.7k but the top decile rose while the middle barely moved, and ~41% of households earn ≥$100k—ample WTP at the top to fill limited slots. (datastories.aarp.org, The Washington Post, AP News, DQYDJ – Don’t Quit Your Day Job…)

2) Launch pricing (skimming with built-in segmentation)

Assume a chronic drug with excellent perceived value (preventive longevity). Set a high anchor, then offer “good/better/best” to self-segment without eroding the anchor.

List prices (annual):

-

Founders/Concierge – $11,000–$12,000: priority supply, same-day concierge, advanced testing, travel clinic options.

-

Standard – $6,000–$8,000: quarterly labs + telemed, 2-day shipping, outcomes guarantee (partial refund if pre-specified biomarkers don’t improve).

-

Access – $3,000–$3,600: financing ($250–$300/mo), fewer visits, community support; released only if you have spare capacity.

Gross-to-net reality check: With limited payer leakage early on, assume ~20–30% gross-to-net (coupons, assistance, refunds). Thus $8,000 list ≈ $5,600 net; $12,000 list ≈ $8,400 net.

Why these price points?

- You only need the top few million buyers among ~124M 50+ adults. The top 10–20% of households ($100k–$235k+) can plausibly afford $6k–$12k/yr for a high-status, healthspan product—particularly when financed monthly and wrapped with concierge services. (Top-10% household threshold ≈ $235k; top-1% ≈ $632k.) (DQYDJ – Don’t Quit Your Day Job…, Census.gov)

3) 4-year capacity-constrained plan

Goal: Maximize profit per limited unit, preserve brand, build real-world evidence (RWE) to unlock payers later.

Year 1:

- Release Concierge ($11–12k) only; capacity ~300–500k.

- Offer N=1 outcomes guarantee + founder badge; cultivate KOL case series.

Year 2:

- Add Standard ($6–8k); keep Concierge at same price with perks.

- Capacity cumulative ~1.2–1.5M.

Year 3:

- Pilot outcomes-based payer contracts (limited geos) using RWE; keep DTC pricing intact.

- Consider Access ($3–3.6k) only to smooth demand gaps or reduce waitlist.

Year 4:

- Broaden payer channels selectively with ceilings on covered volume, preserving DTC tiers for price integrity.

4) Revenue math (illustrative)

Assume net price after gross-to-net.

-

Scenario A (high-tier focus):

400k Concierge @ $8.4k net ⇒ $3.36B

300k Standard @ $5.6k net ⇒ $1.68B

Total ≈ $5.0B/year at ~700k patients

-

Scenario B (mixed tiers, 1M pts):

300k Concierge @ $8.4k ⇒ $2.52B

600k Standard @ $5.6k ⇒ $3.36B

100k Access @ $2.4k ⇒ $0.24B

Total ≈ $6.12B/year

-

Scenario C (value tilt, 1.5M pts):

200k Concierge ($8.4k) ⇒ $1.68B

900k Standard ($5.6k) ⇒ $5.04B

400k Access ($2.4k) ⇒ $0.96B

Total ≈ $7.68B/year

If COGS is typical small-molecule (low) and SG&A/R&D amortized, these net revenues can deliver >60–70% operating margins early. (Exact margins depend on trial amortization and service bundle cost.)

5) Price elasticity & income distribution—what it implies

-

Capacity-limited ⇒ use skimming. As long as demand from the top deciles > supply, raising price increases profit with minimal volume loss.

-

Where the buyers are: With ~41% of households ≥$100k and 90th percentile ≈$235k, you can reliably sell $6–12k/yr programs to a 2–3M subset without touching mass-market tiers—especially with monthly payments and FSA/HSA eligibility. (DQYDJ – Don’t Quit Your Day Job…, AP News)

6) Tactics to expand WTP without cutting price

-

Outcome-backed guarantee (partial refund if agreed biomarker composite fails).

-

Long-term value framing: “+$500k in lifetime health value” via avoided morbidity (white-paper).

-

Financing: $499–$999/mo options keep the $12k anchor.

-

Bundles: add biological age testing, DEXA, CGM cycles, recovery tech—costs little, lifts perceived value.

-

Waitlist + lottery to maintain scarcity signal.

7) What exact “best price” should you post on Day 1?

Given today’s income distribution and your hard volume cap, the profit-maximizing single anchor for launch is:

-

List price: $11,500 per patient-year (Concierge), with a Standard tier introduced later at $7,500.

-

Expected net after 25% gross-to-net: $8,625 (Concierge) / $5,625 (Standard).

This anchor is high enough to:

- Fill capacity from the top deciles (even 0.5–1.0% of the 50+ population is >600k–1.2M people),

- Preserve room for payer-negotiated down-tiers later, and

- Avoid brand dilution while you’re supply-constrained.

If you want, I can spin up a quick sensitivity model (price × mix × capacity × gross-to-net) so you can pick the exact Concierge/Standard split that maximizes Year-1 and Year-2 operating income.