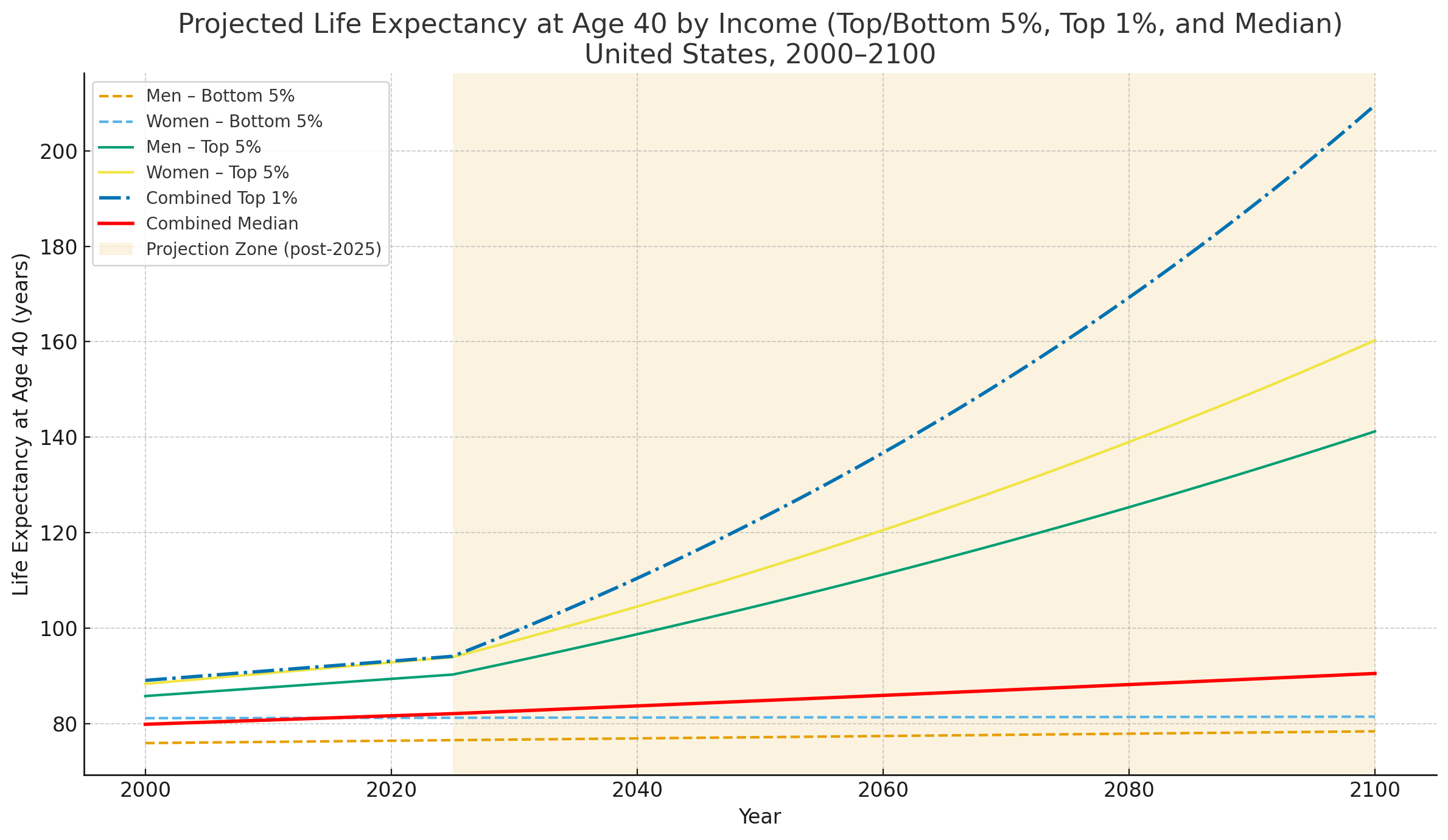

Figure: A hypothetical graph of life expectancy growth by income group given current technology adoption curves in life extension therapeutics.

If and when effective longevity therapies reach the market, even with only moderate efficacy, the gap in annual life expectancy growth could expand from its current 10× level to 50× or even 100×. This divergence would be driven by the wealthy’s ability to adopt therapies earlier, repeat them more frequently, and mitigate risks through intensive monitoring. At what point might human society begin to resemble a bee colony—where a small ‘queen class’ lives five to ten times longer than the worker majority?

Longevity “Network Effects”: The more money you have, the more “longevity” you will be able to buy, the more longevity you buy, the more money you can make…

Introduction

I am extremely optimistic about the potential for people to live much longer, healthier lives due to the geroscience research being done today. At the same time, I’m interested in anticipating and addressing potential "unintended consequences” that may emerge as longevity biotech advances.

In Silicon Valley, we’ve often seen that new technologies and innovations, while transformative, also generate serious problems that were either unanticipated or ignored early on.

- The Internet was initially thought to level the playing field so that small businesses and individuals around the world could sell and prosper more easily. Instead, it created a series of “winner take all” markets and enabled powerful monopolies like Amazon and Google to dominate global e-commerce and capture most of the value.

- Social media was developed with the stated goal of “building community and bringing the world closer together,” but instead has frequently fostered deadly conflict, misinformation, and political polarization through personalized information bubbles.

This history suggests that longevity biotech may also produce outcomes very different from its original vision.

Current Trends and How They Could Converge

Some trends in the longevity field are especially relevant:

- Existing disparities are already stark. The rate of life expectancy growth is ~10× faster for people in the top 5% of incomes in the U.S. compared with the bottom 5%, even with today’s limited technologies.

- Aging is complex, and targeted via many approaches Effective interventions will likely emerge across a wide range of categories (supplements, small molecules, blood-based therapies, gene therapies, organ/tissue replacement). Costs, optimal frequency of use, and availability will vary.

- Longevity Biotech Markets will continue to diversify. A broad array of new products and services will continue to be developed and refined over time.

- Prices may decline over decades. Like most technologies (e.g., cell phones, generic drugs), some therapies will become cheaper over a 20-year adoption curve, but…

- The wealthy will always lead. The top 0.1% of the population will still be able to afford the newest and most effective therapeutics immediately, and to use them at optimal levels without regard to cost.

- Bryan Johnson as a model. Johnson exemplifies how early adoption may occur: rapid uptake of new longevity technologies, intensive and ongoing monitoring/testing, and expert guidance in decision-making.

- The inequality gap could widen dramatically. If these trends hold, the growth rate in life expectancy for the wealthy could expand from its current 10× differential to 50× or even 100×, and grow wider over time.

- Wealth and longevity reinforce each other. The more money you have, the longer you can live; the longer you live, the more money you can accumulate.

Market Adoption Assumptions

Bryan Johnson increasingly represents how longevity therapies are, and likely will be, adopted—especially in the highest income brackets. The typical pattern will be:

- New therapeutic approaches are identified.

- Early safety testing is conducted.

- Treatments are quickly made available via longevity clinics and concierge doctors.

- Adoption depends partly on the risk/reward profile, but heavily on affordability.

- Ongoing monitoring and testing are essential, since individual responses vary.

Most of Johnson’s reported $2 million/year budget goes to testing and validation, not just treatments themselves. While many people copy his diet or supplements, only a small fraction can replicate his full regimen. Still, those with sufficient means are likely to emulate his approach as more validated therapeutics become available:

- Identify and use the highest-probability interventions.

- Implement personalized testing/validation to ensure safety and efficacy.

- Repeatedly use interventions as frequently as possible to maximize benefits.

Those with fewer financial resources will adopt truncated versions of this protocol, constrained by budget.

Longevity Therapeutics Assumptions

Because aging is so complex, there will not be one or two breakthrough interventions, but rather a portfolio of partial solutions with different mechanisms, technologies, and levels of validation. A current sampling illustrates the wide pricing spectrum:

- Supplements: hundreds of dollars per year

- Generic drugs (e.g., rapamycin, metformin): $1,000+ per year

- Patented drugs (e.g., GLP-1s): thousands per year

- Blood-based therapies (e.g., plasmapheresis series): $30,000+

- Gene therapy (e.g., follistatin): $25,000+ at offshore clinics

Market Progress Assumptions

With billions being invested in new startups and basic research, it is reasonable to expect some validated products and services to emerge. As in the past, however, the wealthy will adopt earlier and more fully, while others access less expensive, less effective options when possible.

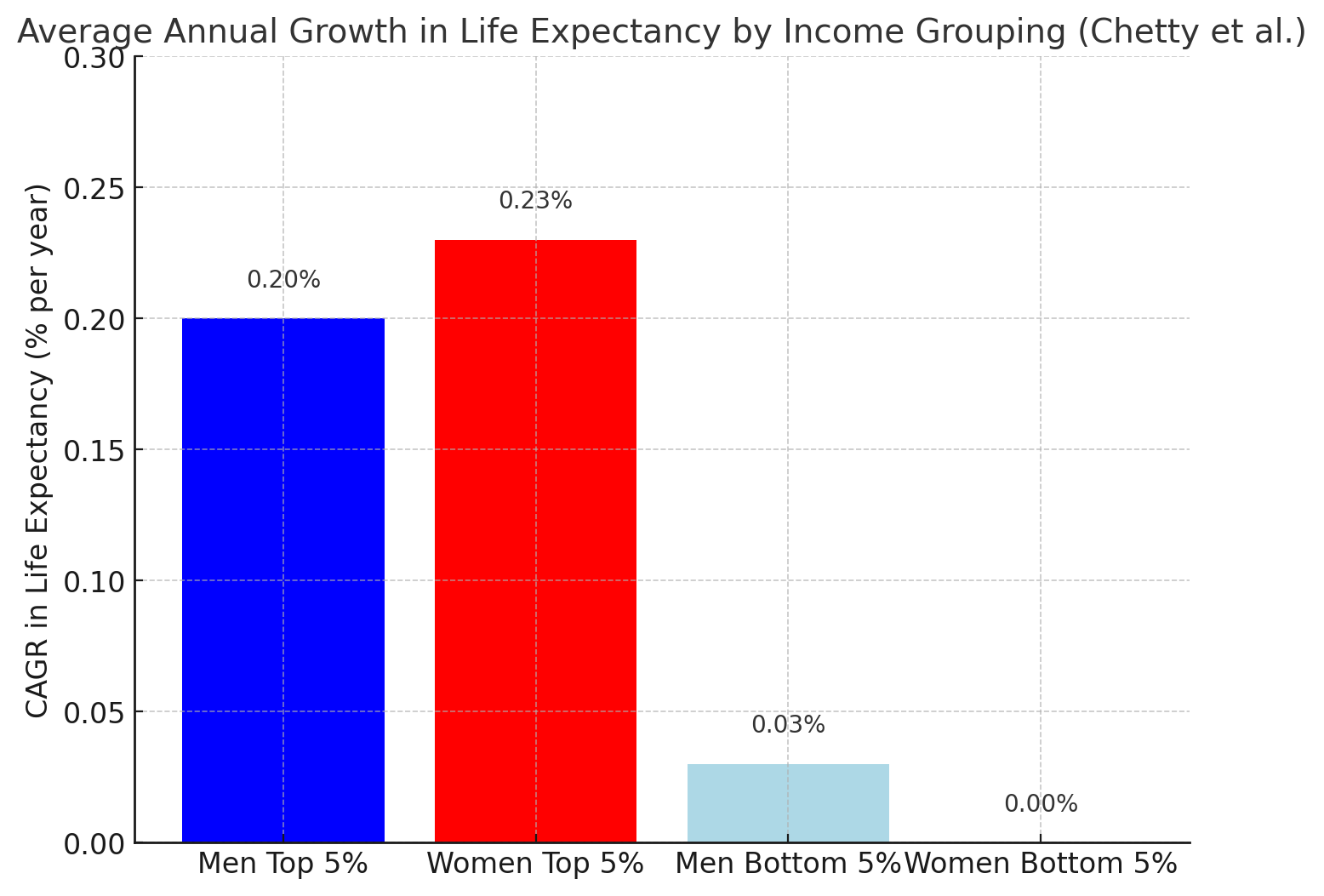

Evidence from the Chetty Study

The Chetty et al. (2016) data already demonstrates how income stratification drives differences in life expectancy growth. Between 2001 and 2014:

- Men, Top 5%: +2.34 years

- Men, Bottom 5%: +0.32 years

- Women, Top 5%: +2.91 years

- Women, Bottom 5%: +0.04 years (flatlined)

Annual growth rates:

- Men, Top 5%: ~0.20%/year

- Men, Bottom 5%: ~0.03%/year

- Women, Top 5%: ~0.23%/year

- Women, Bottom 5%: ~0%/year

In short, life expectancy is already growing 10× faster for the wealthy than for the poor.

The Slope of the Future

If even moderately effective longevity therapies come to market, the wealthy could widen the gap far beyond today’s 10× differential because:

- They will access every treatment, from inexpensive to extremely costly.

- They can afford rigorous monitoring to reduce risks from unproven interventions.

- They can afford repeated treatments (e.g., weekly plasmapheresis at ~$5,000/session).

This could push the gap to 50× or 100×, creating rapidly divergent lifespans.

A Potential Future Problem

What happens if the wealthiest 1% (and authoritarian leaders) gain life expectancy at dramatically faster rates than the bottom 95%?

- Even if prices fall over time, the wealthy will always be first adopters.

- Lifespan inequality will reinforce wealth inequality.

- Society could begin to resemble a bee colony, with a small “queen class” living vastly longer than the majority.

This is not yet a problem, but it could become urgent once validated longevity therapeutics begin to enter the market.

Do you consider this to be a potential problem?

If you do consider this to be a likely problem in the future, what is the answer? How could it be avoided?

Please add your own thoughts on this hypothetical example and research.

==================================================================

The basis for this graph and the data analysis is this research paper published in JAMA in 2016, by Chetty et al:

The Association Between Income and Life Expectancy in the United States, 2001-2014

Assumptions Built Into the Chart

-

2000–2025:

- All groups follow linear projections based on Chetty et al. (2001–2014 observed trends).

- Top 1% is assumed to start ~2 years above the average of Top 5% men/women in 2001 and grow at the same slope as the Top 5% until 2025.

-

Post-2025:

- Bottom 5%: Continue slow linear growth at historical slopes.

- Median Group: life expectancy increases by 1.2X and compounds every 10 years

- Top 5%: Growth accelerates to 3× the historic annual rate, compounded every 3 years.

- Top 1%: Growth accelerates even more—5× the historic annual rate, compounded every 3 years.

Key Takeaways from New Model

- By 2100, the Top 1% line (green) shoots far above all others, diverging massively from both the Top 5% and Bottom 5%.

- Top 1% projected e₄₀: reaches extraordinary levels (well beyond 160 years by century’s end under these assumptions).

- Bottom 5% lines: barely move, creeping upward by only a handful of years across the century.

- Gap dynamics: The disparity between the Top 1% and Bottom 5% grows to more than 80 years difference in life expectancy at age 40.

Key Takeaways from Initial Chetty study:

- In 2001, the gap in life expectancy at age 40 was already huge: ~10 years between the richest and poorest men, ~7 years for women.

- By 2014, the gap had widened further (to ~12 years for men, ~10 years for women).

- Growth rates were 10× faster at the top than at the bottom, and essentially zero for low-income women.